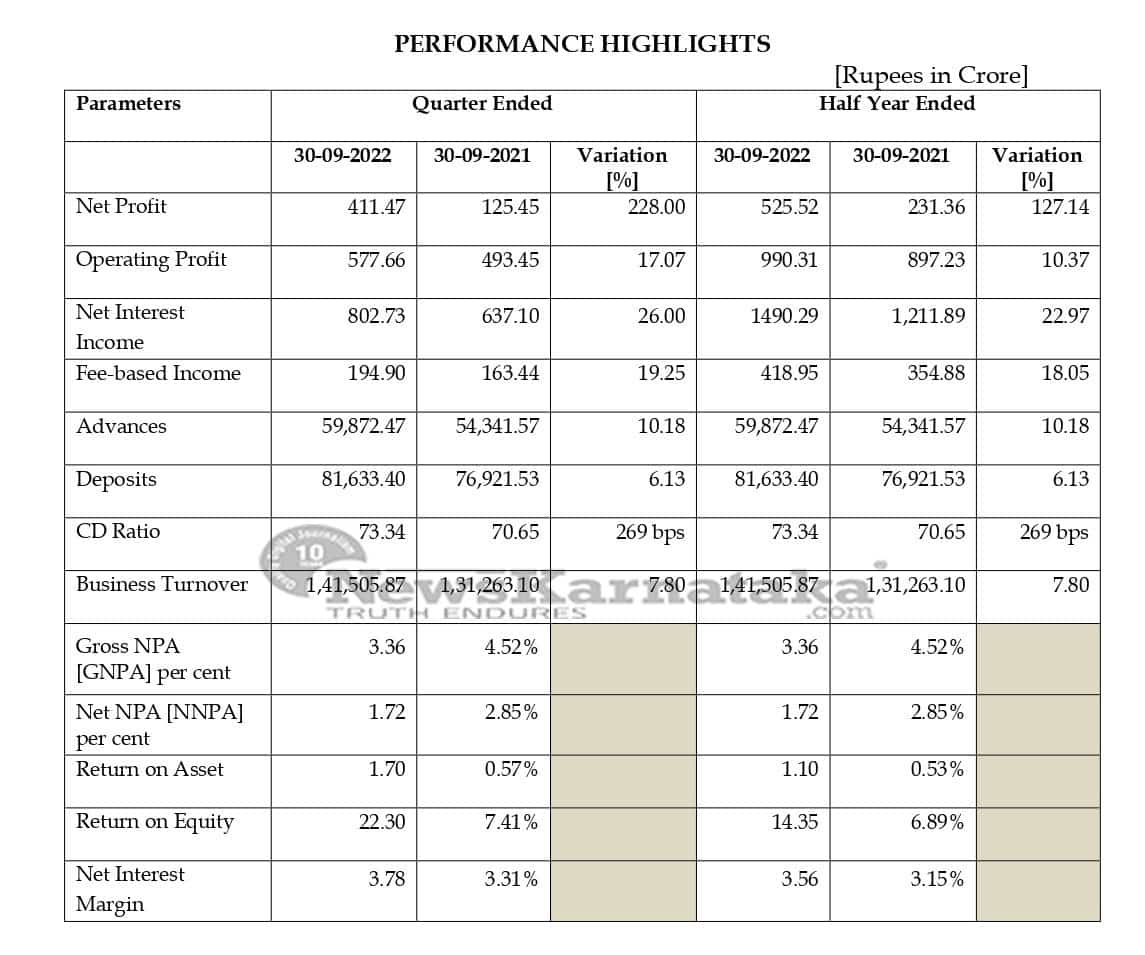

Mangaluru: Karnataka Bank posted an all-time high quarterly Net Profit of Rs 411.47 crore, for the quarter ended Sept-2022, and the net profit grew by 228% compared to the Sept 2021 quarter net profit of Rs 125.45 crore.

In the Meeting of the Board of Directors held today at Mangaluru, the Board has approved the financial results for the quarter and the half year that ended September 30, 2022. Furthermore, for the half year ended September 2022, the net profit stood at Rs 525.52 crore, which is also an all-time high against Rs 231.36 crore of September 2021.

For the quarter ending September 2022, the Net Interest Income also increased by 26.00 % to Rs 802.73 crore from Rs 637.10 crore.

The NPAs have also further moderated as the GNPAs reduced to 3.36 % against 4.03% as of 30/06/22, while NNPAs also reduced to 1.72 % against 2.16% as of 30/06/22. About a year back, i.e. as of 30/09/2021, the GNPA was at 4.52 %, and NNPA was at 2.85 %.

The business turnover of the Bank has touched a new high of Rs 1,41,505.87 crore as of 30/09/2022. Y-o-Y, the deposits of the Bank grew from Rs 76,921.53 crore to Rs 81,633.40 crore, and advances grew from Rs 54,341.57 crore to Rs 59,872.47crore. The CD ratio of the Bank stood at 73.34%.

The Bank’s Capital Adequacy Ratio stood at 15.28 % compared to 14.48 % as of 30-09-2021.

The Net Interest Margin has improved to 3.56 % from 3.15% as of 30/09/2021.

Expressing his happiness on the Q2 FY23 result of the Bank, Shri Mahabaleshwara M.S., Managing Director & CEO of the Bank, said, “Our all-time high Q2FY23 result represents the tipping point of the Bank’s reinvigorated trajectory. Our disciplined execution and aggressive digitalisation, combined with our commitment to superior customer experience, is fortifying Karnataka Bank’s reputation for delivering sustained profitable growth. The milestone of reaching Rs 411.47 crore of net profit earned during the quarter is the highest-ever quarterly profit earned by the Bank. Similarly, Rs 525.52 crores of half-yearly net profit is also a new high. In just six months of the current year, we have already surpassed the last year’s total annual net profit of Rs 507.99 crores. The significant jump in net profit is mainly because of improved earnings, improved asset quality, healthy growth of advances, cost containment, and efficiency enhancement, among others. It is also noteworthy that our core fundamentals across all key performance parameters, such as NIM, PCR, ROI, ROA, and CASA Ratio, among others, have improved materially, signifying the arrival of a ‘New KBL’ as envisaged in our Transformation Journey ‘KBL-VIKAAS’. I am sure that as we cross our 100th year next year, the Bank will continue to create new benchmarks of performance with its ever-growing customer base, user-friendly digital products and committed employees”.

Karnataka Bank Limited

Incorporated in 1924, Karnataka Bank Limited (KBL) is a Scheduled Commercial Bank under Private Sector, serving customers across India. The Bank has ~8,500+ employees and a presence across the metro, urban, semi-urban, and rural centres. The Bank offers personal and business loans to retail, mid-corporate and corporate customers, including the priority sectors such as agriculture and MSMEs, together with large enterprises, housing, personal loans, NBFCs and infrastructure. KBL also offers Savings and Current Accounts; Fixed, Abhyudaya Cash certificates, Recurring Deposits; and Non-Resident Banking services.

The Bank has undergone a digital transformation over the past four years, led by its end-to-end digital channel, which focuses on mobile & internet banking, customer journeys, automated assistance and data analytics. Labelled as ‘KBL VIKAAS 2.0’, the Bank is currently undergoing an accelerated new transformation journey KBL-NxT that will give it resilience for the next few decades of its continual journey. As we advance, the Bank is aiming to become a new-age, ‘Digital Bank of the Future’. It aims to do this by adopting cutting-edge technology and integrating its digital and physical infrastructure.