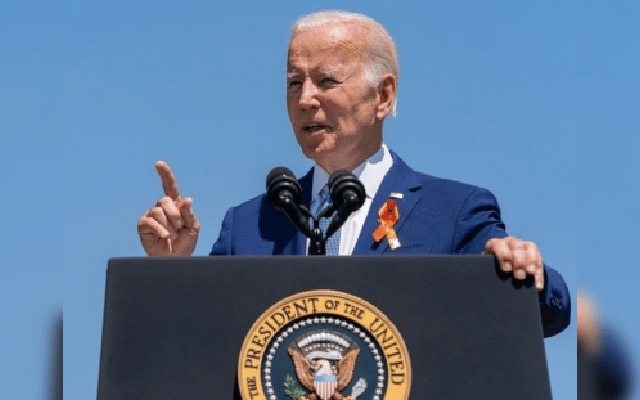

Washington: US President Joe Biden’s historic inflation reduction act that seeks to slap a flat 15 per cent tax on corporates to raise government revenues for climate change, ushering in green technologies and capping prescription drug prices and better health care for the average american stands the danger of being stopped in its tracks if republicans seize control of the Congress in the midterms, two months away.

President Biden’s tax agenda could be stopped in its tracks if Republicans seize control of the House or Senate, shifting attention to what will happen when major pieces of the tax code expire in the coming years, says the Wall Street Journal in a report.

Biden campaigned on tax increases for large corporations and high-income individuals alongside larger tax credits for middle class American families. And he is trying to get the U.S. to implement its piece of a global minimum corporate tax agreement. But Democrats have gotten only a fraction of that through Congress so far with their narrow majorities.

Biden’s tax plan largely hinges on the outcome of the upcoming fall’s midterm elections in November. Republican victory in either the House or Senate would likely create a stalemate on major tax policy, with the GOP’s anti-tax-increase stance clashing with Biden’s proposals. Likewise, given Biden’s veto power, Republicans would struggle to cut taxes, claw back increased Internal Revenue Service funding or reverse the handful of corporate tax increases that Congress just passed, analysts say.

“It’s just very clear that if you have one of the chambers in Republicans’ control, that the majority of the Biden tax plan as we’ve known for several years is simply off the table,” said John Gimigliano, a former House GOP aide now at KPMG LLP.

Biden and White House officials have been eager to draw contrasts with Republicans on taxation issues.

“The president’s economic vision is about continuing to deliver for middle-class families, while congressional Republicans’ agenda is to sell those families out with more tax welfare for rich special interests,” said White House spokesman Andrew Bates. One should recall what Biden said when the climate change and inflation reduction act was passed by the senate and Congress: “We (the people of America) have won while those who represent special interests (republicans favoring the rich industrialists and corporates) have lost.”

Biden’s agenda is to reduce the inequities between the rich billionaires and the working class which now stands at a whopping 28 per cent the highest in American history when compared to Clinton’s era when it stood at just 1.8 per cent. America, the richest nation in the world, stands below Cameroon islands, a tiny country, when it comes to the inequality index – the hiatus between the rich and the poor middle class.

There is potential room for compromise, particularly on deficit-increasing tax breaks that include incentives for retirement savings. Lawmakers could also strike a deal-as soon as this year’s post-election session-on extending business tax provisions from the 2017 Republican tax law that have started expiring or will do so soon.

But on the biggest tax issues, the political gulf might be too wide to bridge. A divided government would turn attention to the 2024 presidential campaign and the end of 2025, when tax rates at all income levels will go up unless Congress acts.

Republicans aren’t campaigning on a unified tax agenda, and with inflation and abortion prominent so far, taxes haven’t been a top-tier issue. The closest thing to a Republican consensus is their view that the 2017 tax cuts (introduced by Trump in thanks giving to the billionaires who funded the party’s wave to power in 2016) were a roaring success and should be extended.

GOP lawmakers cite as evidence strong economic and wage growth that followed its enactment, up until the Covid-19 pandemic triggered a short recession.

But the GOP claim is not entirely true. BBC in a special report claimed the tax cuts to the rich by Trump hurt the middle class very badly when their voice and purchasing power came down. But after Biden took over, he added the maximum number of jobs to blue collar workers, more than his predecessors, Trump, Obama, Clinton and Bush, a steady 60,000 per month.

“We saw the best economy in 50 years,” said Rep. Jason Smith (R., Mo.), one of three candidates to lead Republicans on the tax-writing House Ways and Means Committee next year. “Those changes, those policies made a big difference.”

Economists however feel that the best golden years for the American economy was during the Clinton era. When trust in the government by the people was as high as 70 per cent and the inequity index was as low as 1.8 per cent and middle class wage earning capacity boomed and consumerism grew exponentially when the average wage was $21 per hour whereas now it’s just $7 to $8 per hour. And the middle class stands crushed by high costs of higher college education and health care with insurers raising the premiums.

Robert Reiche, Labour Secretary and head of the economic transition team under President Bill Clinton, hailed the Clinton era as the best era in economic history for the American public.

The echo of the prior Republican majority, still hung over Democrats this year, when their slim majorities made them unable to pass significant pieces of their tax agenda, including reversals of the 2017 law that they all opposed. They couldn’t raise top income-tax rates on individuals or corporations because of objections from Sen. Kyrsten Sinema (D., Ariz.). She was opposed to carried over interest taxes being scrapped and wanted corporations to be taxed as an alternative and that’s how the 15% tax was introduced in the inflation reduction act as a compromise, which actually was estimated to yield more than $80 billion, way above the carried over interest taxes.

Due to opposition from Sen. Joe Manchin (D., W.Va.), they didn’t raise taxes on U.S. companies’ foreign income and they didn’t secure a long-term extension of the expanded child tax credit that was in place for 2021, the 15 per cent tax as suggested by Sinema from Arizona was introduced.

If Democrats retain House control and expand their Senate majority enough so they don’t need to rely on Ms. Sinema and Mr. Manchin, those plans could get revived. However, the president’s party typically struggles in midterm elections, and political forecasters expect Republicans to pick up seats in the House.

Democrats have also been unable to implement the U.S. piece of the 15 per cent global minimum tax deal that Treasury Secretary Janet Yellen negotiated. The other section of that deal-giving more taxing power to countries with large consumer markets-would require congressional approval, and Republicans are unlikely to support such a move.

Rep. Adrian Smith (R., Neb.) said the minimum tax is a nonstarter that would reduce competition. “The realities of all these countries agreeing to what they’ve laid out and sticking to them, I think that’s highly unlikely,” said Smith, also contending to be the top Republican on Ways and Means. “The question is what we tolerate along the way.”

Administration officials say the minimum tax would put a floor under corporate tax payments, and the other part of the deal would bring order to a chaotic area marked by unilateral actions and trade disputes, WSJ analysts said.

Even if they can’t enact legislation, Republicans could use the next two years to decide whether they back straight extensions of the 2017 Trump tax cuts or changes to that law. Many of the Republicans who wrote the 2017 tax law have already left office, with more following this year.

That law permanently cut the corporate tax rate to 21 per cent from 35 per cent, but Republican lawmakers intentionally set major pieces of the individual tax system to expire. That move made it easier for them to cut taxes while complying with budgetary rules that enabled them to enact that law without Democratic votes.

So, unless Congress acts, major changes from the 2017 law will be reversed. Income-tax rates will go up. The standard deduction, child tax credit and estate tax exemption will go down. The alternative minimum tax will return to affect millions of upper-income households. The $10,000 cap on state and local tax deductions will vanish, along with a special deduction for owners of closely held businesses, analysts feel.

During the Obama administration, expiring Republican tax cuts for most households were made permanent, but those for the highest-income Americans were allowed to lapse. That could happen again. Republicans in Congress-and GOP presidential candidates who will start announcing their tax plans after they begin campaigning-may not necessarily want to accept what then-President Donald Trump and that Congress did.

The 2017 tax law didn’t achieve several long-held conservative aims, including estate tax repeal and capital-gains tax cuts. The budget proposed by the Republican Study Committee, a group that includes most House Republicans, calls for faster deductions for buildings, estate tax repeal, tying capital gains to inflation and full repeal of the state and local tax deduction.

Rep. Vern Buchanan (R., Fla.) said he might press for deeper tax cuts for closely held businesses that don’t pay the corporate tax but have their profits pass through to their owners’ individual tax returns. “I think there could be a little bit more fairness in terms of pass-through entities,” said Buchanan, another Ways and Means committee member.