Robert Huish, Dalhousie University

When U.S. President Joe Biden released the first wave of sanctions on Russia on Feb. 22, he vowed to make Vladimir Putin “a pariah on the international stage” for his aggression against Ukraine.

The Biden administration began by sanctioning two Russian banks and 42 of their subsidiaries, five Russian-flagged cargo vessels, tankers and container ships, and three men who make up Putin’s inner circle, and their family members. By the end of the week, after Putin’s forces had fully invaded Ukraine, the U.S. Treasury had scaled-up its actions, disrupting Russian banks’ access to U.S. dollars. The European Union, United Kingdom and Canada have all followed with similar measures.

Many have called the scale of the sanctions “unprecedented,” but let’s be clear: The price Russia has paid for its invasion of Ukraine amounts to economic penalties against two large financial institutions, dozens of smaller Russian entities and some of Putin’s known associates, so far.

The U.S. is now preparing sanctions on Putin and Foreign Minister Sergey Lavrov, and the EU has said it will freeze Putin’s assets.

But how effective are such sanctions? The simple answer is, not very.

Slow start

While the U.S. Treasury Department has frozen U.S.-based assets held by Russian financial institutions, the department is allowing for a 30-day window for international partners to “close any correspondence” with the Russian firms. This means the U.S.-dollar pipeline will be shut off in a month, plenty of time to move money around.

What’s more, these sanctions can only be enforced within the U.S., Canada and the EU, unless other countries also impose them. Finances moving between Moscow and other financial hubs, such as India or China, may not affected.

Losing access to billions of U.S. dollars is no picnic, but there are workarounds. Russia has created expendable entities to trade with countries that the U.S. considers rogue. For example, the Kremlin nationalized the bank Promsvyazbank so that it could buy arms and deflect sanctions that might be put in place against other Russian banks, such as Sberbank and VTB, two of the largest.

(AP Photo/Dmitri Lovetsky)

Russia has also actively de-dollarized its financial system. Between 2013 and 2020 Russia reduced the amount of dollars in its foreign debt to 24 per cent from 40 per cent.

Russia used to own US$100 billion of U.S. Treasury debt, yet as of 2020 it held only US$10 billion, and some estimates suggest it could be as low as $2.5 billion. By comparison, Colombia holds $33 billion.

Whereas Russia’s trade with China was almost all in U.S. dollars in 2013, less than half of it is now, even though trade between the two countries has increased in other currencies. As for Russia’s military trade with India, it’s all in rubles. This is why U.S. dollar sanctions do not pack the punch they once did.

Cryptocurrencies on the move

What’s more, Russia is digging deep into cryptocurrencies to trade with international partners and evade sanctions. Heavily sanctioned nations like North Korea and Venezuela have dabbled with cryptocurrencies in the past to move funds, seek credit and purchase debt. The U.S. Treasury Department has recently warned that it has little power over digital currencies.

In 2019, Sberbank bought US$15 million in debt using blockchain. Siberia is a massive hub for cryptocurrency mining, allowing Russia to earn millions of dollars in cryptoassets, making up for some limitations imposed by sanctions.

(Alexei Nikolsky, Sputnik, Kremlin Pool Photo via AP)

When it comes to sanctioning ships, it is a quick game of cat and mouse. As North Korea has shown, there is a proven track record of using offshore shell companies, and flags of convenience to work around sanctions. The ships can also simply avoid U.S. or European ports.

Personal pain

Targeting Putin’s personal finances and those of his lieutenants could cause some pain. In their present form, however, the sanctions are misguided — they can only take aim at clearly marked assets in the U.S., Europe or Canada. Putin and other Kremlin-connected elites have their wealth safely stashed in the British Virgin Islands.

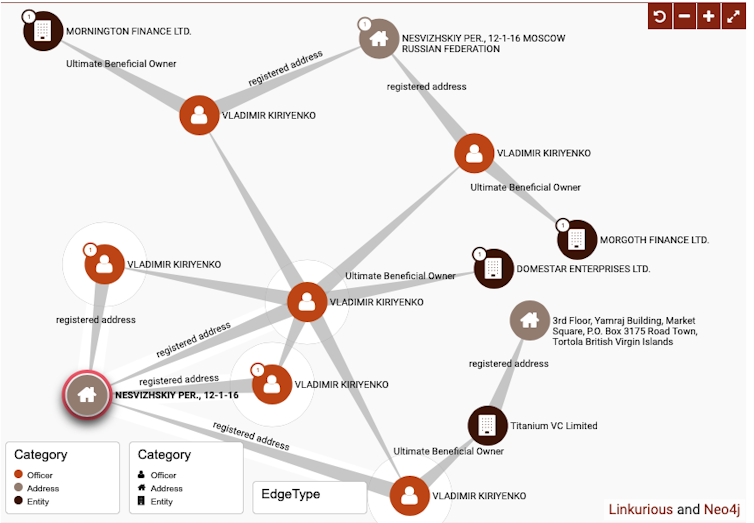

Vladimir Kiriyenko, named on the Treasury Department’s sanction list, is a media mogul who helped Russia increase its control over internet access. His wealth is tied to Titanium VC, a firm that invested heavily in Russian internet startups.

The Pandora Papers — 11.9 million leaked financial documents of some of the world’s wealthiest people — revealed in 2021 that TitaniumVC is based in the Yamraj Building in Road Town, BVI. The documents also revealed how Russian and Ukrainian ministers, including Oleksandr Kubrakov, Ukraine’s minister of infrastructure also own shell companies at the same address.

(ICIJ Offshore Leaks Database), CC BY-SA

On paper, Putin appears to have little wealth. Instead, the Panama Papers show he has tucked away up to US$2 billion through shell firms run by his lieutenants.

For Biden’s sanctions to have any impact on the present conflict, they must also target offshore capital. They should ban Russia from the SWIFT payment network, just as the EU and Canada is pursuing, to block the rapid transfer of money across borders, and prevent those tied to Putin from establishing subsidiary shell companies. However, China’s CIPS system could provide a temporary lifeline to the Kremlin.

Targeting offshore capital hubs like the BVI may inevitably shine the light on the finances of other global elites and even western politicians, which may explain the lack of appetite to do so. While many offshore capital hubs like Seychelles and Malta are reluctant to impose sanctions, the BVI has a sanctions regime in place and it can participate in international financial measures.

Thanks to the information from the Pandora Papers and other offshore leaks, we know where the funds are — they are hiding in plain sight — yet no western government has had the constitution to go after them.![]()

Robert Huish, Associate Professor in International Development Studies, Dalhousie University

This article is republished from The Conversation under a Creative Commons license.