Mangaluru: M.C.C. Bank Ltd has achieved exceptional performance across all financial parameters during the Financial Year 2023-24, declaring a dividend of 10% to its shareholders. The Bank recorded an unprecedented net profit of ₹10.45 Crores for the first time in its history in the Financial Year 2023-24.

The Bank convened its 106th Annual General Meeting at Loyola Hall, St Aloysius P.U. College, Kodialbail, Mangalore, on Sunday, 22nd September 2024, at 11:00 AM. The Chairman of the Bank, Sahakara Ratna Mr. Anil Lobo, presided over the meeting.

Tributes were paid to the members who passed away in the previous year, and the meeting began with a prayer led by the staff. The event started with the lighting of the lamp by Chairman Sahakara Ratna Mr. Anil Lobo, Vice Chairman Mr. Jerald Jude D’Silva, and Director Mr. David Dsouza, followed by floral tributes to the Founder of the Bank, P.F.X. Saldanha, by Chairman Mr. Anil Lobo, Vice Chairman Mr. Jerald Jude D’Silva, and other distinguished members, including Mr. Edmund Frank (Ex Vice Chairman of MCC Bank), Mr. Rons Bantwal, Mr. Rohan Monteiro (Managing Director, Rohan Corporation), Mr. Louis Pinto (President, Mand Sobhan), and Mr. Pius L Rodrigues (Ex. Director, Karnataka Pollution Control Board).

In his address, the Chairman stated, “During FY 2023-24, the Bank earned a record net profit of ₹10.45 Crores, with a total deposit of ₹635.70 Crores, recording a 10% increase over the previous year; total advances of ₹444.88 Crores, reflecting a 25.21% increase over the previous year; working capital of ₹752.95 Crores, with a growth of 10.03%; and share capital of ₹31.21 Crores, showing a growth of 14.07% as of 31.03.2024. The NPA of the Bank has been reduced to 1.12%, compared to the NPA percentage of 1.37% in 2022-23. The provision coverage ratio stands at 78.34% of the total NPAs, and the Return on Assets (ROA) is at 1.39%. The Bank is maintaining an adequate CRAR (Capital to Risk Assets Ratio), which stands at 23.06% as of 31st March 2024, well above the required rate of 9.00% as per the Reserve Bank of India. The Bank’s business turnover increased from ₹933.25 Crores to ₹1,080.58 Crores as of 31st March 2024, thereby crossing ₹1000 Crores in business during FY 2023-24. The Bank has also opened its 17th branch at Brahmavara after a gap of 22 years. The overall performance of the Bank has been highly satisfactory. I thank all our customers, members, staff, and well-wishers for their contribution to this achievement.”

The Chairman also informed that the Reserve Bank of India has granted the necessary permission to extend the Bank’s area of operation to the entire state of Karnataka and has permitted the opening of new branches. He thanked the Directors, members, and staff of the Bank for their unwavering support and cooperation. He emphasized the importance of contributions made by borrowers, which have led to business growth, higher profits, and a reduction in NPA through prompt loan repayments. He informed the members that the Bank has been offering loans at competitive interest rates and requested their support in bringing good proposals to the Bank. He further shared the Bank’s future plans, including the opening of 10 new branches, shifting the Udupi, Moodbidri, Karkal, and Kulshekar branches to new premises for customer convenience, providing digital banking facilities like Google Pay, PhonePe, UPI, etc., and extending branches across Karnataka. He also mentioned that the Bank has prepared a 10-year action plan after detailed discussions on its vision, mission, and goals. He sought constructive suggestions and cooperation from the members to implement these plans and take the Bank to greater heights.

Vice Chairman Mr. Jerald Jude D’Silva read the minutes of the 105th AGM. The audited financials for 2023-24, the audit report and compliance, the program of activities for the financial year 2024-25, the budget for 2024-25, and amendments to the bylaws of the Bank were presented and approved by the AGM.

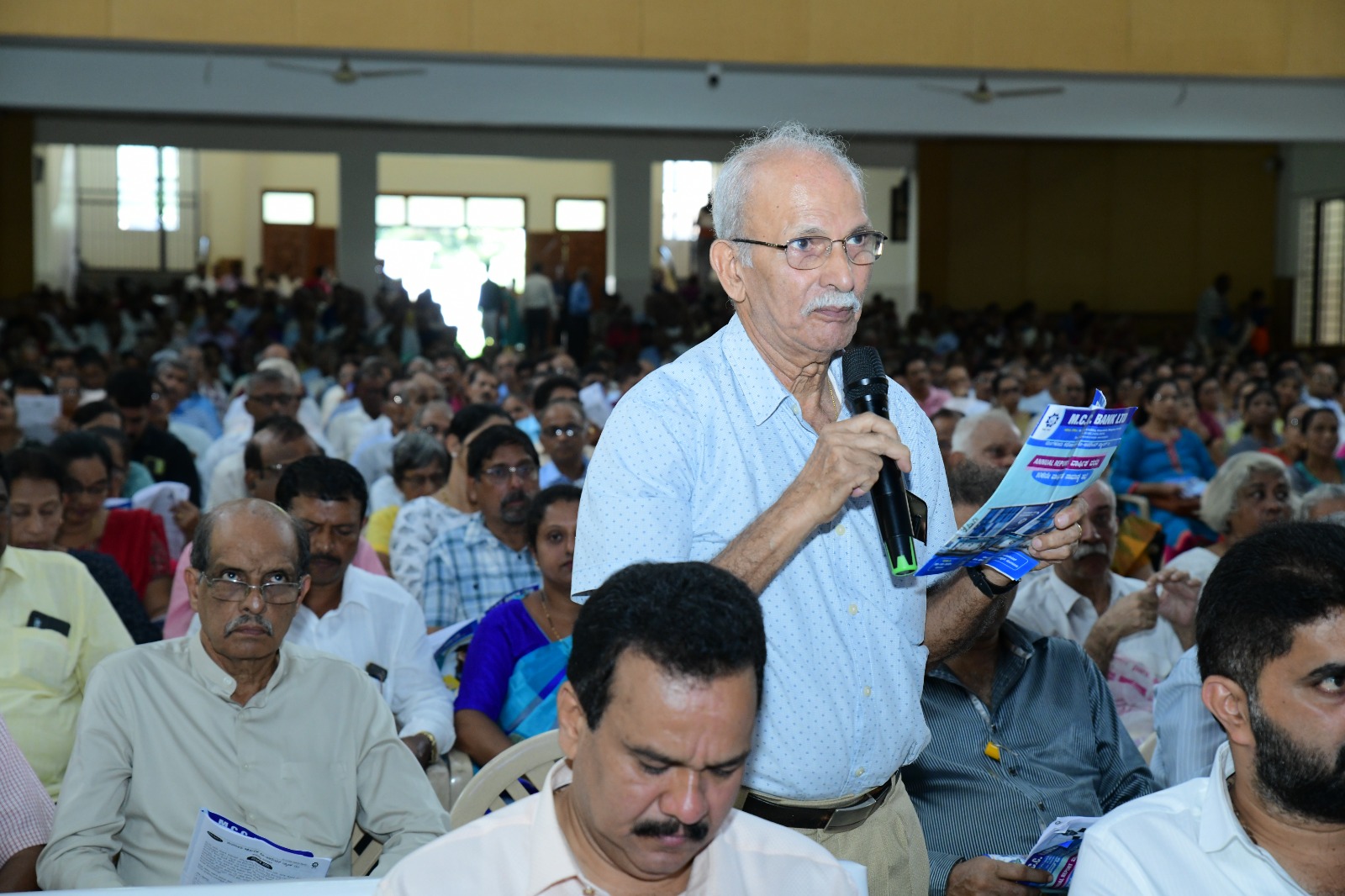

The Chairman addressed and clarified all queries raised by the members during the meeting and assured them that efforts would be made to implement their suggestions.

Directors Mr. Andrew D’Souza, Mr. Joseph M. Anil Patrao, Dr. Gerald Pinto, Mr. David D’Souza, Mr. Elroy Kiran Crasto, Mr. Roshan D’Souza, Mr. Herald Monteiro, Mr. J.P. Rodrigues, Mr. Vincent Lasrado, Mr. Melwin Vas, Mrs. Irene Rebello, Dr. Freeda D’Souza, Professional Directors C.G. Pinto, Sushanth Saldanha, General Manager Sunil Menezes, and Deputy General Manager Raj F. Menezes were present at the meeting.

General Manager Mr. Sunil Menezes welcomed the members, Mr. Owin Rebello, Branch Manager of Brahmavara Branch, compered the event, and Chairman Sahakara Ratna Mr. Anil Lobo proposed the vote of thanks. The meeting concluded with the National Anthem.

Also Read:

Bengaluru Traffic Police Crack Down on Errant Private Bus Drivers – News Karnataka