By reading this complete blog, you will :

✓ Understand the complete 12A and 80G registration process from start to finish

✓ Avoid the 5 most common mistakes that lead to rejection

✓ Know exactly which documents you need and how to prepare them

✓ Master the online filing process on the Income Tax portal

✓ Learn how to respond to departmental queries confidently

✓ Discover insider tips that can save you 2-3 months of processing time

Quick Summary: If you’re running an NGO, charitable trust, or non-profit organization in India and want to offer tax benefits to your donors while enjoying tax exemptions yourself, you’ll need 12A and 80G registrations. The process involves legally establishing the NGO, collecting accurate documents, submitting Form 10A online with precise details, undergoing a review by the tax authority, and obtaining registration certificates. Successfully navigating this helps NGOs secure tax benefits and build donor trust. This guide is for founders, trustees, and administrators who may feel overwhelmed by the registration process.

Overview

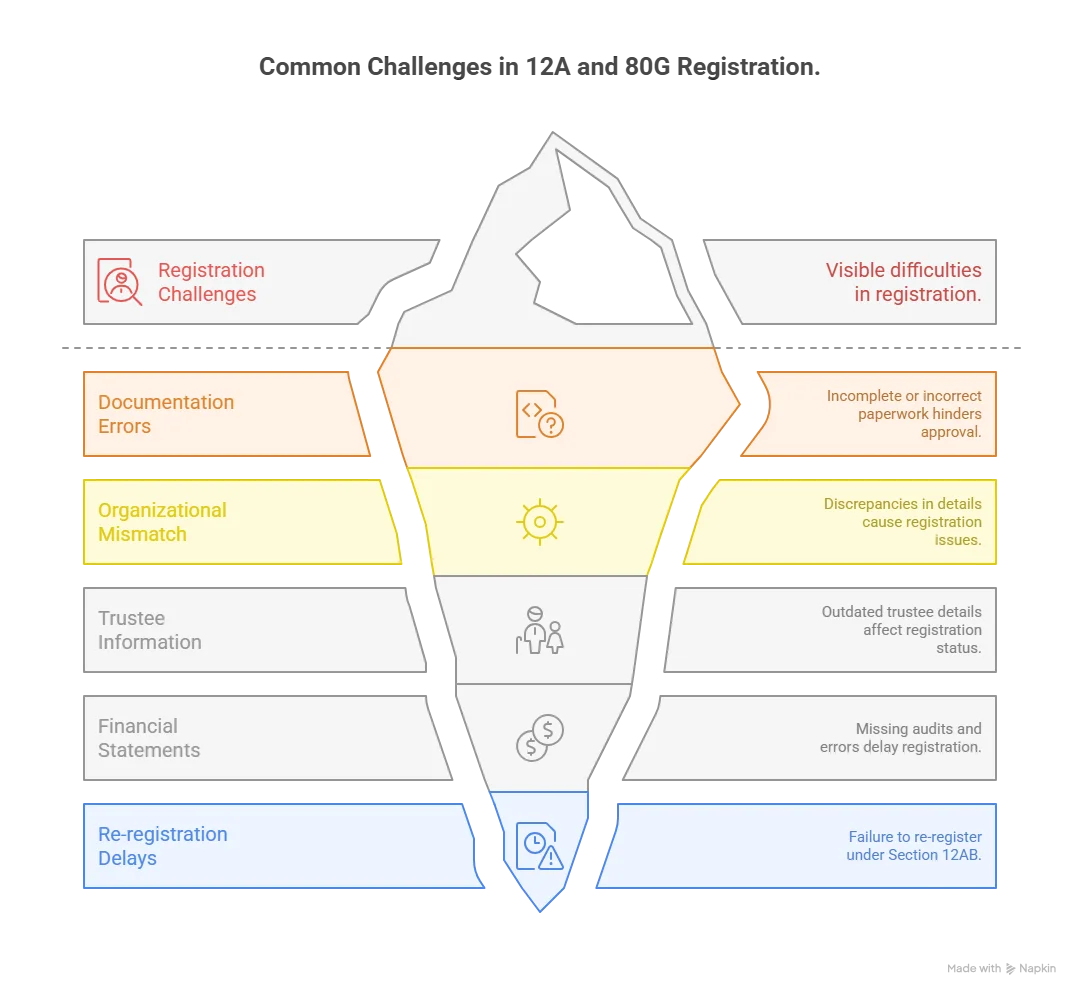

To run charitable trusts, societies, and Section 8 companies successfully, an NGO needs to obtain 12 A and 80 G registration. Although this registration comes with significant benefits for the NGO, it is also true that numerous founders face complex challenges when it comes to legal formalities associated with the registration process. It has been observed that many NGO founders often find themselves confused and face challenges during the registration process, including incomplete documentation, mismatched details, a lack of clarity on compliance requirements, and delays due to procedural errors.

However, with the right approach, proper guidance, and this comprehensive roadmap, you can navigate the 12A and 80G registration process smoothly and successfully.

This guide will walk you through everything you need to know about how to navigate the challenges of 12 A and 80G registrations without the usual headaches.

The Basics of 12A and 80G Registration

If you run or plan to start an NGO in India, 12A registration and 80G registration are special provisions under the Income Tax Act that can help both your organization and your donors save money on taxes.

Here’s how it works together:

- With a 12A registration, your NGO is exempt from paying income tax on donations used for charitable purposes.

Example: “Helping Hands Trust” receives ₹10 lakhs in donations annually. Without 12A registration, they might pay ₹2-3 lakhs in income tax (depending on income slabs). With 12A, they pay ZERO tax: that’s ₹2-3 lakhs more for their charitable activities!

- With 80G registration, your NGO and your donors can get tax benefits for the money they donate.

Example: If someone donates ₹10,000 to your 80G-registered NGO, they might save ₹3,000-5,000 in taxes (depending on their tax bracket)

12A vs 80G: Quick Comparison Table

| Feature | 12A Registration | 80G Registration |

| Who benefits? | Your NGO | Your donors |

| Main benefit | Tax exemption on NGO income | Tax deduction for donors |

| Tax saving | NGO saves tax on surplus income | Donors save 50-100% of the donation amount in taxes |

| Mandatory? | Yes, if you want a tax exemption | Optional, but highly recommended |

| Can you apply alone? | Yes, apply first | No, need 12A first |

| Validity | 3 years provisional, then apply for final | 3 years provisional, then apply for final |

| Application form | Form 10A | Form 10A |

Why both matter: Having 12A saves your organization money, while 80G attracts more donors. Together, they might be the most powerful tools for your NGO’s financial sustainability.

Understanding the Common Challenges in 12A and 80G Registration

1. Incomplete or incorrect documentation

· On submitting the Missing or unsigned trust deed / MOA & AOA / registration certificate.

· Not uploading the latest amended deed (after registration or name change).

· Utility bill/address proof not matching the registered address.

Solution:

- By reviewing your trust deed or MOA, ensure that it matches the charitable objects under Section 2(15) of the Income Tax Act.

- Have proof of ongoing charitable activities (minimum 6 months’ recommended).

2. Financial and activity-related deficiencies

- No or incomplete financial statements for the last 3 years (or from inception).

- Mismatch between activities claimed and expenditure shown in accounts.

- Donations and grants not routed through books or unsupported by bills/vouchers.

- Lack of segregation between corpus and revenue donations.

- High administrative expenses without programmatic spend.

- No proof of actual charitable activity (e.g., photos, reports, project details).

Solution

- To overcome these financial issues, NGOs must maintain complete and accurate financial statements for each fiscal year, ideally audited by a qualified chartered accountant. This includes segregating corpus funds from revenue donations to ensure clear accountability.

- NGOs should systematically Strengthen Documentation and proof of their charitable work with project reports, photographs, and beneficiary feedback.

3. Non-compliance during the provisional period

- Failure to start a charitable activity within the provisional period (3 years).

- No filing of Form 10A/10AB for final registration within the prescribed timeline.

- Not filing ITR-7 during the provisional period (a big reason for rejection).

- Mismatch between ITR data and financials uploaded during 10AB filing.

Solution

- NGOs must ensure that charitable activities begin within the stipulated provisional period of three years.

- Organizations should file Form 10A at the time of initial provisional registration and submit Form 10AB for converting provisional registration to final registration within the prescribed timelines (generally at least six months before expiry or onset of activities).

4. Governance and control issues

- Reflecting the Profit motive, such as paying salaries to related parties without justification.

- Clauses missing in deed:

o Irrevocability clause

o Utilisation of income only for charitable purposes

o Dissolution clause specifying asset transfer to another 12A-registered trust

- Amendments in objects not intimated or approved by the Income Tax before applying.

Solution

- Incorporate Mandatory Legal Clauses in the Trust Deed. Adding these clauses aligns the trust deed with legal standards under the Indian Trusts Act and Income Tax Act and safeguards it from challenges related to governance or tax exemption eligibility.

- Keeping detailed records of board decisions and approvals for such amendments. This approach fosters compliance, strengthens donor confidence, and ensures uninterrupted tax benefits

5. Technical/procedural issues

· Filing Form 10AB under wrong section code (12A or 80G mix-up).

· Upload errors or non-digitally signed documents.

· No proper authorization by a trustee/director with DSC.

· Departmental queries in the portal are not replied to within a reasonable time.

Solution

- Ensure filing Form 10AB under the correct section code (either 12A or 80G) by thoroughly verifying instructions and selecting the appropriate option on the Income Tax portal to avoid application rejection.

- Always upload digitally signed documents authorized by designated trustees and respond within the stipulated timelines to maintain smooth processing and compliance

6. Activity not qualifying as a charitable purpose

· Activities too commercial in nature, such as training with fees, product sales without subsidy.

· NGO claims to serve the general public but gets more than 20% of its income from business-like activities; it breaks the rules and risks losing exemptions.

· No proof of public benefit or clear beneficiary segment.

Solution

- Ensure that revenue-generating activities such as training with fees or product sales are truly incidental and sufficiently subsidized so that they do not dominate the NGO’s operations, in compliance with charitable rules under Section 2(15) of the Income Tax Act.

- Monitor that business-like income does not exceed 20% of total receipts if the NGO claims to serve the general public, to safeguard tax exemptions.

7. Misunderstanding between Provisional vs Final Registration

· Many NGOs assume provisional 12A/80G is an automatic renewal, but it is not.

· You must reapply in Form 10AB within 6 months of commencement of activities or 6 months before expiry, whichever is earlier.

· If missed, both provisional approvals lapse, and a fresh provisional must be retaken.

Solution

For existing NGOs (Those with Old 12A/80G registrations before 2021), the old registrations became non-operative after April 1, 2021, so you need to re-register.

Action plan:

- Check registration status on the IT portal

- Apply for provisional registration under the new Section 12AB

- You can use your historical data (past 3 years) as proof of activities

- Once a provisional is granted, you can apply for a final immediately

By understanding these common challenges, NGOs can better prepare and streamline their 12A and 80G registration process, minimizing delays and achieving successful approvals.

Pro Tip:

When appointing new trustees, choose people who:

- Have stable careers and addresses (frequent changes create documentation issues)

- Understand the commitment (so they don’t resign suddenly)

Quick Tips to Make Your Registration Journey Smoother

✓ Start early: Don’t wait until the last minute. Begin gathering documents months in advance.

✓ Keep digital copies: Maintain a cloud folder with all important documents. You’ll need them multiple times.

✓ Maintain clean accounts: From day one, keep proper books of accounts for enhanced clarity.

✓ Get professional help early: Even if you’re doing it yourself, have a CA or legal advisor review your documents once.

✓ Join NGO forums: Connect with other NGO founders. They might have faced similar challenges and can offer practical advice.

✓ Document everything: Keep records of all your charitable activities, including photos, beneficiary lists, and expense receipts.

✓ Be patient but persistent: Government processes can be slow. Follow up regularly but politely.

✓ Stay updated: Tax rules change. Subscribe to CBDT notifications or follow reliable tax advisory websites.

Must-Have NGO Registration Checklist (2025)

| When | What You Need | Quick Why |

| Before You Start | Trust deed/MOA with legal objectsPAN cardBank account in the NGO nameGovernance (trustee) list | Legal proof, ready for checks |

| During Application | Form 10A/10GAll fields checkedAudited accountsAll PDF uploads as requiredDigital signature | Avoids most rejections |

| After Submission | Save acknowledgmentTrack portal/email for updatesRespond early | Stay in control, avoid delays |

| Post-Approval | Print certificatesUpdate records & display certsPlan renewals | Maintains tax and donor trust |

Conclusion

Obtaining your 12A and 80G registrations no longer has to be a nightmare. With proper planning, clear understanding, and the right guidance, you can navigate this process successfully. At NGOExperts, we understand that your passion is changing lives, not navigating government portals. We’ve helped hundreds of NGOs like yours secure their 12A and 80G registrations without the usual stress and delays.

Ready to get started? Contact NGOExpert today for a free consultation.

FAQs

Q: Can I apply for 80G without 12A registration?

A: No, 12A registration is mandatory before applying for 80G.

Q: What is Form 10A?

A: Form 10A is the application form for 12A and 80G registration submitted online to the Income Tax Department.

Q: How long does 12A registration take?

A: Usually, it takes 3 to 6 months, depending on completeness and verification.

Q: What if my NGO’s registration is rejected?

A: You may rectify the issues cited and reapply after addressing the concerns.