With the advent of technology in the finance sector, more and more processes have found their way to the digital space. With online financial processes, you no longer have to wait for days for your loan to be approved and funds to be deposited in your account. With an instant personal loan, you can have funds in your account within minutes of applying for the loan and uploading the necessary documents. Personal loans can be used for anything—paying school fees, planning a trip, meeting wedding expenses, attending a medical emergency and whatnot.

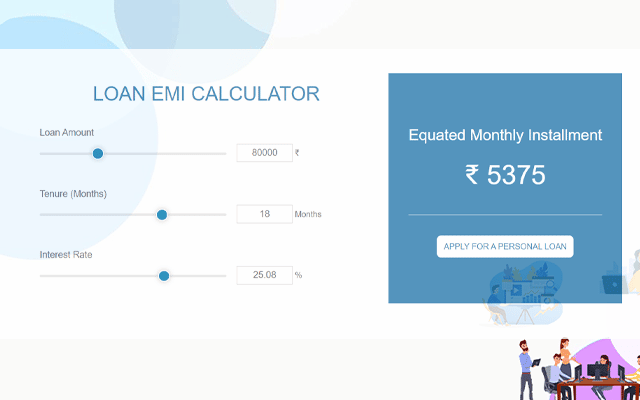

You can apply for an instant personal loan using a loan app. Make use of its additional features such as a loan EMI calculator, interest calculator, and eligibility calculator to create a strong loan application. Today, we will discuss how an EMI calculator can help you know your EMI for a particular loan amount and tenure.

What is an EMI?

The Equated Monthly Instalment or EMI is a set monthly payment that a debtor makes to pay off both the interest and the initial loan amount. It is paid over a predefined period until the debt is completely paid off. EMI is an important component to consider if you are looking for a personal loan or any other kind of loan product. Your EMI is determined by three factors—total loan amount, interest rate, and loan tenure. An EMI calculator, which is easily found on the websites of most financial institutions, helps you calculate your EMI amount even before you apply for a loan. Compared to manual EMI calculations, it is more reliable and fast.

By knowing your EMI amount in advance, you can plan your monthly budget better. Also, by tweaking values on the EMI calculator, you can get to know the best personal loan amount that you can manage to repay along with other expenses. This allows you to make a cost estimate and obtain loans within the estimated limits.

What are the factors affecting your EMI?

EMI calculators help you to calculate your EMI amount in advance. Online EMI calculators provide reliable results in seconds. The loan application, approval, and transfer of your loan amount are done within 24 hours, and after a month your EMI cycle starts.

Wondering what factors affect EMI? Here is a list of those factors:

- Change in rate of interest: An interest rate change can be anything, it could be positive, negative or none. The EMI will fluctuate based on the market rate. As a result, if there is any change in the rate of interest there will be a change in your EMI as well.

- Term of the loan: Any changes in the loan period have an impact on the EMI. A loan with a shorter repayment time has a higher EMI, while loans with a longer repayment period have low EMIs.

- Loan prepayment: Some people sort to prepay their loan, and while doing that your principal loan amount and interest are also reduced, directly impacting your EMI. Make sure to have a check for any prepayment loan penalty before you finalize your loan agreement.

- Credit history: If you have a credit score above 750 you have a better chance of getting a loan at a reduced interest rate, thus, bringing down your EMI amount.

- Job-status: Your chance of getting a loan with low-interest rates increases with a steady source of income. It provides the benefit of planned EMIs because the interest rate is not high.

- Balance loan transfer: When you move your current loan to a new lender, the EMI changes.

How does a personal loan EMI calculator work?

Using a personal loan app, you can get a loan of up to Rs 1.5 lakh. A loan app usually has an in-built loan EMI calculator that computes monthly payments in minutes and provides reliable results. Once you have appropriated your EMI amount, you can make a quicker decision for loan application and disbursement.

The operation of an online personal loan EMI calculator is determined by three variables—the loan amount, period, and interest rate. You can experiment with different combinations of these three factors by moving the blue dot on your screen until you get an appropriate EMI.

This EMI calculator helps you save time by calculating the EMI automatically, avoiding laborious calculations.

How to use a loan EMI calculator?

Doing serious math has become a cakewalk with a loan EMI calculator. Now, you can easily know your monthly EMI with a few clicks of your mouse. Some people fear that online EMI calculators are complex to use and may yield wrong results. However, it is not true at all. As mentioned above, you just need to enter three values and you’ll have results on your screen within seconds. An EMI calculator is incredibly simple to use and needs no training to get started. Here’s a step-by-step guide for it:

- Enter information such as loan amount, term, and interest rate.

- A single click will show you the EMI amount as per the information entered by you.

- If necessary, revise your EMI by tweaking other values.

- By changing the loan amount, tenure and interest rates, you will get different results for EMI. Pick the combination that suits you the best.

A loan EMI calculator is a boon to many personal loan applicants. Furthermore, it is easily available on the loan app. With it, you don’t have to waste your precious time calculating your EMI manually. An EMI calculator considers all the factors and provides you with an estimate of your monthly EMI.

Remember that the greater the interest rate, the bigger your EMI will be, and the longer the length, the lower your EMI.