Image: Shri Srikrishnan H, Managing Director & CEO and Source: Karnataka Bank

Mangaluru: In the meeting of the Board of Directors held today at Karnataka Bank headquarters, the Board has approved the financial results for the quarter that ended June 30, 2023.

Karnataka Bank has posted a Net Profit of Rs. 370.70 crores, during Q1 of FY24 as against Rs. 114.18 crores recorded during the corresponding quarter of the previous financial year, i.e. Q1 of FY 23, with an Year on Year growth rate of 224.66 per cent.

The operating profit of the Bank stood at Rs. 601.17 crores and Net Interest Income stood at Rs. 814.68 crore as at the quarter ended 30.06.2023.

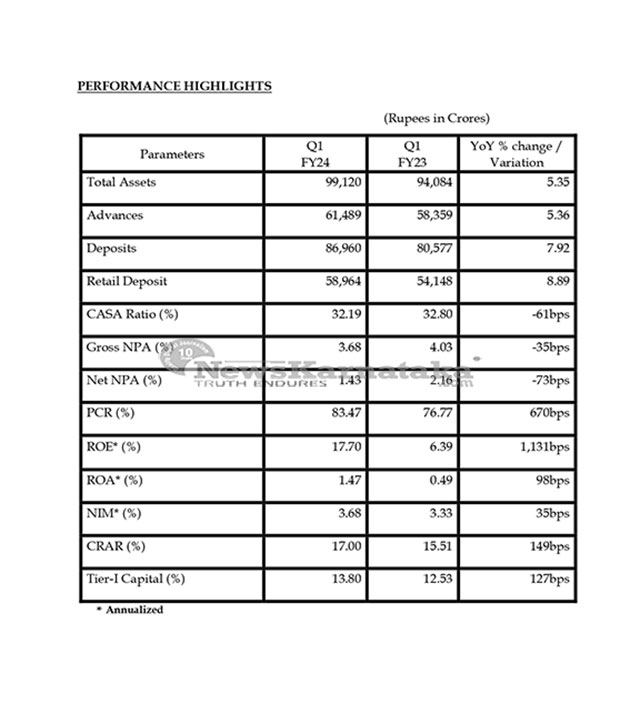

The business turnover of the Bank was at Rs. 1,48,449.27 crore as of 30-06-2023 compared to Rs. 1,38,936.17 crore as of 30-06-2022 registering a YoY growth of 6.85 per cent. The deposits of the Bank stood at Rs. 86,959.86 crore with a YoY growth of 7.92 per cent and the advances at Rs. 61,489.41 crore with a YoY growth of 5.36 per cent.

The loan book quality is steadily improving. Gross NPAs declined to 3.68 per cent as of 30-06-2023, compared to 4.03 per cent in the corresponding Q1 quarter of the previous FY 23.

Similarly, Net NPAs [NNPAs] also declined to 1.43 per cent from 2.16 per cent in the corresponding Q1 of the previous FY-2022-23. Both GNPAs and NNPAs also moderated compared to Q4 of FY 23.

The Bank is making steady progress in its customer franchise building. The Bank acquired 1.72 lakh new customer accounts in the quarter. The Bank also did well in the sale of Mutual Funds and Co-branded Credit cards. The Bank’s retail advances growth continued during the quarter as well.

The Capital Adequacy Ratio of the Bank has further improved to 17.00 per cent as compared to 15.51 per cent as of 30-06-2022. The Bank further strengthened its Balance Sheet by increasing Provision Coverage Ratio to 83.47 per cent as of 30-06-2023 from 80.86 per cent as of 31-03-2023 and 76.77 per cent as of 30.06.2022.

Commenting on the Q1 FY24 financial results of the Bank, Shri Srikrishnan H, Managing Director & CEO of the Bank, said “Karnataka Bank, with our strong fundamentals, is rightly positioned to leverage the franchise strengths and poised for accelerated growth.

Having made the right investments in Technology, we will re-align our Processes and People to deliver in identified business areas, i.e. MSME, Retail and Agri. We will work towards creating tech-enabled business models including partnering with new-age FinTechs that will supplement our growth aspirations.”